The U.S. has one of the best climates for solar power in the world and is home to some of the best solar companies and manufacturers. For homeowners who are looking for clean energy solutions and big savings, solar power is utterly essential. Our solar calculator can get you a quick estimate of how much you could save by switching to solar. The benefits of solar power go beyond just saving money on your energy bills; you can take complete control of your electricity use and energy efficiency, reducing or even eliminating your reliance on utility companies. Even more impactful, you can directly lower greenhouse gas emissions and your reliance on fossil fuels, which provides a number of tangible environmental benefits.

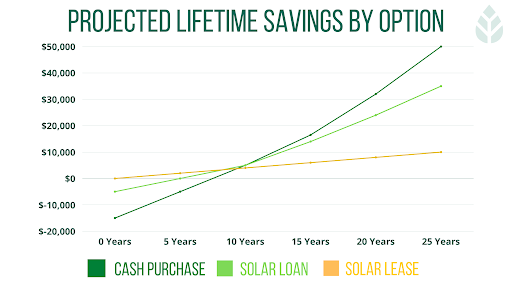

If you have the funds, paying in cash will maximize your long-term savings. For those without the necessary cash flow, a solar loan will make the most sense. Leases, for the most part, are still guaranteed to save you money, but they come with fewer benefits and less flexibility. To get a quick estimate of the lifetime savings you could experience with solar, use our solar calculator.

Avg. lifetime savings over 25 years (10 kW)

Avg. payback period

Avg. cost without tax credit (5-10 kW)

Avg. cost with tax credit (5-10 kW)

Avg. cost (in CA)

Avg. annual power production (10 kW)

Home Solar System Size

U.S. Solar Panel Cost

Cost After Federal Tax Credit*

6 kW

$15,960

$11,810

7 kW

$18,620

$13,779

8 kW

$21,280

$15,747

9 kW

$23,940

$17,716

10 kW

$26,600

$19,684

11 kW

$29,260

$21,652

12 kW

$31,920

$23,621

U.S. solar panel cost by home solar system size, before and after federal tax credit:

Cash purchased Before 26% solar tax credit

Financed Before 26% solar tax credit

Leased Estimate for average lease cost

Homeowners should keep in mind their expected solar panel payback period, or the amount of time it will take to recoup their investment, by state. The cost of your home solar system can vary greatly, depending on the total federal and local tax credits.

Not all systems completely offset the energy you’d typically purchase from your utility company. But solar panels can increase your property value by up to $15,000, according to the Department of Energy.

Most residential solar systems will produce electricity for 20 to 30 years and require very little maintenance. The costs/savings vary based on how you purchased the panels (bought outright, financed, or leased). To get a quick estimate of what you can save by making the switch to solar, use our solar calculator!

The best way to determine whether your home is a good fit for solar electricity is to contact a solar installer in your area. A solar energy specialist can come to take a look at your home and give you a custom recommendation.

Solar panel efficiency can convert over 20% of the sunlight’s energy into electricity, especially if your roof is obstructed by little shade and faces south or west.

In states that have a solar sales tax exemption, the purchase of solar panels may be shielded from sales tax. Currently, at least 25 states offer a solar sales tax exemption and 36 states offer solar property tax incentives.

2021

26%

2022

26%

2023

22%

2024

10% (for commercial installations only)

2021

26%

2022

26%

2023

22%

2024

10% (for commercial installations only)

by year placed in service

26%

2021

26%

2022

22%

2023

10% (for commercial installations only)

2024

*for commercial installations only

The information on our website is general in nature and is not intended as a substitute for competent legal, financial or electrical engineering advice. As forecasting solar savings involves assumptions about future electricity prices you should be aware such estimates are inherently uncertain.