With a nickname like the Sunshine State, it’s no wonder Florida has become one of the top states for solar energy — only Texas and California installed more solar over the past few years. The cost of solar panels in Florida is below the U.S. average, which makes them affordable for more potential users as well. There are also a number of solar tax exemptions and incentive programs in the state, which you can combine with the 26% federal tax credit to get costs even lower. If you are interested in a quick estimate of the cost and savings structure for switching to solar, you can use our solar calculator to get an estimate in minutes.

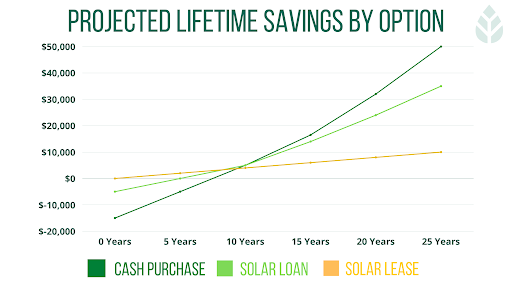

If you have the funds, paying in cash will maximize your long-term savings. For those without the necessary cash flow, a solar loan will make the most sense. Leases, for the most part, are still guaranteed to save you money, but they come with fewer benefits and less flexibility. To get a quick estimate of the lifetime savings you could experience with solar, use our solar calculator quiz.

Avg. lifetime savings over 25 years (10 kW)

Avg. payback period

Avg. cost without tax credit (5-10 kW)

Avg. cost with tax credit (5-10 kW)

Avg. cost in FL

Avg. annual power production (10 kW)

Home Solar System Size

Florida Solar Panel Cost

Cost After Federal Tax Credit

9 kW

$22,770

$16,850

10 kW

$25,300

$18,722

11 kW

$27,830

$20,594

12 kW

$30,360

$22,466

13 kW

$32,890

$24,339

14 kW

$35,420

$26,211

15 kW

$37,950

$28,083

Cash purchased Before 26% solar tax credit

Financed Before 26% solar tax credit

Leased Estimate for average lease cost

Floridians use a lot of energy. When paired with its generous government incentives, solar provides significant economic upside to Florida homeowners looking to make the switch to solar. When installed correctly, some Florida homeowners see thousands in savings within their first year.

Although the cost of solar in Florida is more feasible than most other U.S. states, the upfront cost can still be significant. To get a better idea of what solar could cost you, check out our solar calculator quiz by providing your zip below.

Solar panel efficiency varies depending on your latitude — the further south you are in the U.S., the more you’ll get out of a small system. The best way to determine whether your home is a good fit for solar electricity is to contact a solar installer in your area. A solar energy specialist can come to take a look at your home and give you a custom recommendation.

Solar panel efficiency can convert over 20% of the sunlight’s energy into electricity, especially if your roof is obstructed by little shade and faces south or west.

Florida is well-known as the Sunshine State because of its year-round sunny weather that draws millions of tourists each year, but historically, Florida hasn’t actually been a national leader when it comes to solar energy generation. That said, financial incentives like Florida solar tax credit and rebate opportunities have played a huge part in its rise to become one of the top states for solar energy.

Regardless of the state, one of the most critical types of energy policy for solar panels is known as net metering. Through net metering, Florida residents can feed excess electricity produced by their solar panels into the power grid in exchange for utility credits. These credits can be used to pay for the energy a home uses and even lead to profit for those that consume less than they produce.

Net metering tends to be a state-by-state policy, as there is no federal policy regarding net metering. Florida is one of the states where there is, in fact, a statewide net metering program, applicable for homeowners regardless of which utility serves their area.

The specific net metering provision covers up to 2 megawatts (MW) of capacity for any customers who generate electricity with a renewable energy source. Florida Power & Light (FPL), and Duke Energy have the largest net metering programs in the state.

Another financial mechanism that the Florida state government offers to solar system owners is solar tax exemptions. To start, Florida doesn’t want to make the upfront cost to purchase and install solar equipment to be any higher than the open market says it should be, so since 1997, all solar photovoltaic systems have been completely exempt from Florida’s sales and use tax. Once a solar PV system is purchased and installed, there is a statewide property tax abatement that further helps homeowners avoid paying taxes on it.

Floridians can also benefit from all the tax incentives, rebates and credits that are offered at the federal level. Over the past two decades, the federal solar investment tax credit (ITC) has attributed largely to the rapid growth in solar energy across business sectors, geographies and customer types. For systems installed and operational before the end of 2022, the federal solar tax credit is equal to 26% of the value of the installation, dropping to 22% for systems installed in 2023.

2021

26%

2022

26%

2023

22%

2024

10% (for commercial installations only)

2021

26%

2022

26%

2023

22%

2024

10% (for commercial installations only)

by year placed in service

26%

2021

26%

2022

22%

2023

10% (for commercial installations only)

2024

*for commercial installations only

The information on our website is general in nature and is not intended as a substitute for competent legal, financial or electrical engineering advice. As forecasting solar savings involves assumptions about future electricity prices you should be aware such estimates are inherently uncertain.