Pros and cons of installing solar panels

Homeowners should keep in mind their expected solar panel payback period, or the amount of time it will take to recoup their investment, by state. The cost of your home solar system can vary greatly, depending on the total federal and local tax credits.

Not all systems completely offset the energy you’d typically purchase from your utility company. But solar panels can increase your property value by up to $15,000, according to the Department of Energy.

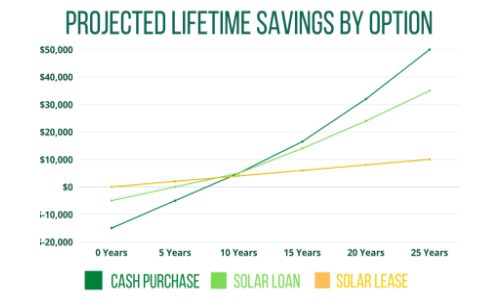

Most residential solar systems will produce electricity for 20 to 30 years and require very little maintenance. The costs/savings vary based on how you purchased the panels (bought outright, financed, or leased).